Interaction

I have sent in the filled proposal form and paid for my health insurance policy. When will I receive my policy document and health cards?

Generally, once you have submitted the proposal form and medical tests if required and made payment, you receive your policy by email within 2 working days and another 2- 3 days for the hard copy through courier. The health cards may take longer as they are sent directly by the TPA and it may take about a month. If you still do not receive the cards, do send us a mail so that we can follow up with the insurance company.

I have received the Policy document but did not receive the FPR ( First premium receipt ). Is it essential to have FPR.

First Premium Receipt is an evidence of adjustment of premium & acceptance of risk but then once the Policy is issued which is the evidence of contract, FPR becomes irrelevant. But then it is always advisable to have FPR also along with Policy document which can be showed as a proof, in case the Policy document is lost.

Can a person have more than one Health policy?

Yes. But each company will pay its rateable proportion of the loss, liability, compensation, costs or expenses. E.g. If a person has Health Insurance from company X for Rs. 1 Lac and Health Insurance from company Y for RS. 1 Lac, then in case of a claim, each policy will pay in the ratio of 50:50 up to the SI.

What is the benefit of carrying a health card?

The benefit of carrying the Health Card is that you and your family members get access to the cash less facility from the TPA’s network of hospitals. This means you can walk into any of the networked hospitals across the country and get treated without having to pay for your bills first and then claim form us. If you do not get admitted to a networked hospital, your expenses will be reimbursed within 7 days of receipt of complete documents from you. Also in the event of any unforeseen accident a third party can identify your Insurance Company and your family can be intimated.

What if I don’t remember my Card Number and Policy Number and I am in an emergency situation?

A. In case you are in an emergency situation, TPA can search your details based on the following: Name, Address, Date of Birth Insurer Underwriting Office Code

I had health insurance 4 years back. How can I renew it?

You can renew your health policy only within 15 days of expiry of the previous policy(asper IRDA regulation).The company may at its discretion allow renewal within a maximum of 60 days from the expiry of the previous policy. As already four years have passed since the expiry of your policy, you need to purchase a new health insurance plan.

Can we add our new born to our existing family/family floater health policy?

Some insurance companies allow mid term inclusion of infants once they are three months old while the others allow inclusion of members only at the time of renewal.

Am I eligible for reimbursement of cost of health check-up under my policy

As per standard norms the insured shall be entitled to reimbursement of medical cost once in every four underwriting years subject to no-claim during this period. The cost shall not exceed 1% of sum insured during the block of four years.

What is a cumulative bonus in a health insurance policy?

The sum insured is increased by 5% for each claim-free year of insurance subject to a maximum accumulation of 50% during ten years.

What happens to the cumulative bonus in case there is a case there is a claim in that particular year?

In the event of a claim, the increased percentage of the Sum Insured will be reduced by 10% on next renewal but the basic sum insured will remain the same.

Is there any discount in the premium if I include my family in my insurance policy?

Yes, a discount is allowed in the total premium in the total premium to a family comprising the insured and any one or more of the following- ? Spouse ? Dependent children ? Dependent parents

What is the procedure to get Reimbursement in case of emergency hospitalization?

1 Take admission into the hospital. 2 As soon as possible, inform TPA about the hospitalization 3 At the time of discharge, settle the hospital bills in full and collect all the original bills, documents and reports. 4 Lodge the claim with TPA for processing and reimbursement by duly filling in the claim form & enclosing all original bills/vouchers/receipts.

What is the procedure to get Reimbursement in case of planned hospitalization?

1 Inform TPA about the planned hospitalization. 2 Get admitted into the hospital as planned. 3 At the time of discharge, settle the hospital bills in full and collect all the bills, documents and reports. 4 Lodge the claim with TPA for processing and reimbursement by duly filling in the claim form & enclosing all original bills/vouchers/receipts.

Is maternity covered in health insurance policies?

Most of the companies do not cover maternity and related conditions but some companies like Apollo Munich, Max Bupa have specific plans which cover maternity after specified waiting periods generally 2-4 years.For details please visit our health page.

Can I cancel my policy and if yes will I get my premium back?

Yes, the insured can cancel the policy at any time. In such a case, the company shall allow a refund of premium at company’s short period rate(given below provided no claim has occurred during the policy period up to cancellation. Period of cover up to Rate of premium to be charged 1 month ¼ of the annual rate 3 months ½ of the annual rate 6 months ¾ of the annual rate  More than 6 months Full annual

What are the situations under which one may be denied cashless hospitalization?

1. If there is any doubt in the coverage of treatment of present ailment under the Policy 2. If the information sent to TPA is insufficient to confirm coverage 3. If the ailment/condition is not being covered under the policy 4. If the request for pre-authorization is not received by TPA in time In such a situation, the Insured can take the treatment, pay for the treatment to the hospital and after discharge, send the claim to TPA for processing.

How does one get Reimbursements in case of treatment in non- network hospitals

In case of treatment in a non-network hospital, TPA will reimburse you the amount of bills subject to the conditions of the policy taken by the insured. The insured must ensure that the hospital where treatment is taken fulfils the conditions of definition of Hospital in the Mediclaim policy. TPA should be contacted within 7 days from the time of admission with the following documents in original: 1 Claim Form duly filled and signed by the claimant 2 Discharge Certificate from the hospital 3 All documents pertaining to the illness starting from the date it was first detected i.e. Doctor's consultation reports/history 4 Bills, Receipts, Cash Memos from hospital supported by proper prescription 5 Receipt and diagnostic test report supported by a note from the attending medical practitioner/surgeon justifying such diagnostics. 6 Surgeon's certificate stating the nature of the operation performed and surgeon's bill and receipt 7 Attending doctor's / consultant's / specialist's anesthetist's bill and receipt, and certificate regarding diagnosis 8 Certificate from the attending medical practitioner / surgeon that the patient is fully cured 9 Details of previous policies if the details are not already with TPA except in the case of accidents

How can I check the status of my claim

You can call the helpline number of your TPA or check on their site using your Policy number or member id. Helpline numbers and links for TPA website are available on our website.

In case of part settlement can an insured claim for the balance amount

Normally, part payments are made due to deficiency of documents or for expenses which are not covered under the policy. In case of the former if the requisite documents are made available, the claim may be considered.

Can any claim be rejected or refused

Yes, the claim, which is not covered under the policy conditions, can be rejected. In case you are not satisfied by the reasons for rejection, you can represent to the insurer within 15 days of such denial.

Will I get the entire amount of the claimed expenses

The entire amount of the claim is payable, if it is within the Sum Insured and is related with the in-house treatment as per policy conditions and is supported by proper documents, except the expenses which are excluded.

Will the medical costs be reimbursed from day one of the cover

Kindly check the plan benefits and policy wordings.

Should the claim be submitted to the Insurance Company or TPA

The claim has to be submitted directly to the TPA for timely settlement.

During the course of my treatment, can I change the hospitals

Yes it is possible to shift to another hospital for reasons of requirement of better medical procedure.However, this will be evaluated by the TPA on the merits of the case and as per policy terms and conditions.

What documents are needed for processing claims if the treatment has been done in a non-network hospital or in a network hospital where cash less facility was not granted /availed

Following documents are required for processing the claims on reimbursement basis: 1. Claim Form properly filled and signed by the claimant 2. Discharge Certificate from the hospital 3. All documents pertaining to the illness starting from the date it was first detected i. Bills, Receipts ii. Cash Memos from hospital supported by proper prescription iii. Receipt and diagnostic test report supported by a note from the attending medical practitioner/surgeon justifying such diagnostics. Surgeon's certificate stating the nature of the operation performed and surgeon's bill and receipt iv. Attending doctor's / consultant's / specialist's / anesthetist's bill and receipt, and certificate regarding diagnosis v. Certificate from the attending medical practitioner / surgeon that the patient is fully cured 4.  Details of previous policies : if the details are not already with TPA except in the case of accidents

What documents should one obtain before discharge from the hospital in case of cashless facility availed

All bills in original and a discharge certificate are to be left with the hospital providing cashless treatment The patient has to countersign all bills and fill the claim form and also leave the same with the hospital at the time of discharge. A copy of the bills & Discharge Summary can be carried by the patient for his records and for submission along with Pre & Post Hospitalization bills.

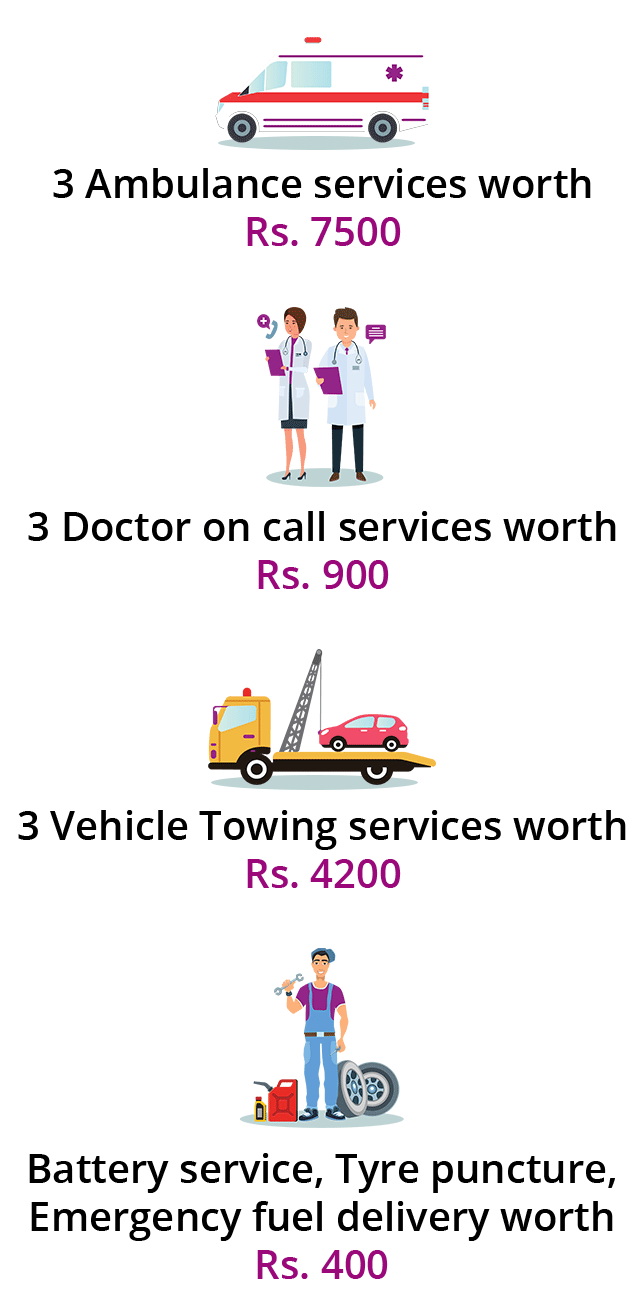

What are the facilities offered by a TPA

1 A 24 X 7 assistance to all policy holders through toll free number of the TPA 2 Online assistance during hospitalization and filing of claim documents 3 Assistance in providing Ambulance Services during Emergency 3 Enrollment Card against your policy, which would give you access to TPA services. 4 Cash Less service facilitation at network hospitals up to limit authorized by Mediclaim / Hospitalization Insurance 5 Claims Processing and Reimbursement for non-network hospitals 6 Other services as defined by your Employer / Insurer

I want to avail the benefits of portability and switch my health policy to another insurer. What is the procedure for that

For this as per IRDA guidelines, a policyholder should apply to the insurance company at least 45 days before the premium renewal date of the existing policy. And the policyholder has to fill in the portability form (provided by the insurer) along with proposal form and submit it to the insurance company. The insurer shall communicate its decision to the requesting policyholder within 15 days of providing all the details required by the insurer and if the insurer does not communicate its decision within 15 days, it shall not retain the right to reject such proposal.

I am currently covered under group health insurance along with my family members. Can I switch to an individual or family floater plan

Yes, with the launch of health insurance portability from 1st October , 2011, you can switch from group health policy to individual or family floater with the same insurer and after one year, you can avail portability as applicable for other individual or family floater policies.

In case of family floater health insurance what happens if the primary insured person expires? Can the policy be renewed by any of the surviving members of the policy? Also,As my age increases can I migrate from family floater to individual plan

If the primary insured person expires, the other Insured Persons may apply to continue the Policy within 30 days of his/her death provided that they have identified a new adult policyholder who is a member of their immediate family. All relevant particulars in respect of such person (including their relationship) must be given to the company along with the application. If the company accepts such application, then the Policy shall be treated as having been renewed without any break in cover. Migration from family floater to individual may be allowed on acceptance of proposal by the company.

As not all the companies provide top up cover, is it possible to buy a main policy from one company and buy the top up from some other company? Also, If main policy covers the critical illness, will the top up cover it too

Yes, you can buy health insurance policy from one company and a top up plan from another. Just make sure that your main policy has sum insured equal to the threshold level of top up plan.

What are first year/ second year exclusions

During the period of insurance cover, the expenses on treatment of certain diseases such as cataract, hernia,piles, sinusitis, benign Prosthetic Hypertrophy, Hysterectomy for Menorrhegia or Fibromioma etc. for specified periods (Please refer to your policy document for details) are not payable if contracted and/ or manifested during the currency of the policy.

Enlist some of the important exclusions under mediclaim policy.

Some general exclusions under this policy are: 1 Pre-existing diseases i.e. Any condition, ailment or injury or related condition(s) for which insured person had signs or symptoms and/or was diagnosed and/or received medical advice/treatment within 48 months prior to his/her health policy with the company. Pre existing diseases will be covered after a maximum of four years since the inception of the policy 2. Any disease contracted during the first 30 days of inception of policy except in case of injury arising out of accident 3. Certain diseases such as cataract, piles, hernia, and sinusitis etc. are excluded for specified periods if contracted or manifested during the currency of the policy. 4. Injury or Diseases directly or indirectly attributable to War, Invasion, Act of Foreign Enemy, War like operations. 5. Cosmetic, aesthetic treatment unless arising out of accident. 6. Cost of spectacles, contact lenses and hearing aids 7. Dental treatment or surgery of any kind unless requiring hospitalization 8. Charges incurred at Hospital or Nursing Home primarily for diagnostic, x-ray or laboratory examinations, without any treatment. 9. Naturopathy or other forms of local medication 10. Pregnancy & childbirth related diseases 11. Intentional self-injury / injury under influence of alcohol, drugs 12. Diseases such as HIV or AIDS 13. Expenses on vitamins and tonics unless forming part of treatment for disease or injury as certified by the attending physician. 14. Convalescence, general debility, run-down condition or test cure, congenital external diseases or defects or anomalies, sterility, venereal disease

What is the procedure for change of address for medical insurance

You can change the address by giving a request letter to the insurance company on plain paper and the insurance company will pass the endorsement and give a copy of same to you. Kindly remember to send same to your TPA also so that they can incorporate same in their records.

I have purchased a Policy from ................Insurance Co. but I am not satisfied. Can I cancel the Policy & get back my money that I paid.

If you are not satisfied with the terms & conditions of the Policy or the benefits which appears in the policy are not the same which was explained to you by the intermediary, you have an option to cancel the policy within 15 days from the date of receipt of Policy document ( free look period) & get back your money less the taxes and medical cost if any, borne by the Insurer in case of Non linked Policy & Fund value less taxes and medical cost in case of Unit linked Policy.

I have lost the Policy document, will there be any problem to get the Policy benefits in future.

As Policy document is the evidence of contract and it also mention about the beneficiary details, for all kind of benefit payments the policyholder has to submit the original policy document to the Insurer’s office. Moreover it is required for necessary endorsement related to Nomination, Assignment, mortgage etc. In case of lost policy, you have to apply to your Insurer for a duplicate policy.

I have purchased a Policy from ................Insurance Co. but I am not satisfied. Can I cancel the Policy & get back my money that I paid

If you are not satisfied with the terms & conditions of the Policy or the benefits which appears in the policy are not the same which was explained to you by the intermediary, you have an option to cancel the policy within 15 days from the date of receipt of Policy document ( free look period) & get back your money less the taxes and medical cost if any, borne by the Insurer in case of Non linked Policy & Fund value less taxes and medical cost in case of Unit linked Policy.

I have received the Policy document but did not receive the FPR ( First premium receipt ). Is it essential to have FPR.

First Premium Receipt is an evidence of adjustment of premium & acceptance of risk but then once the Policy is issued which is the evidence of contract, FPR becomes irrelevant. But then it is always advisable to have FPR also along with Policy document which can be showed as a proof, in case the Policy document is lost.

I have lost the Policy document, will there be any problem to get the Policy benefits in future.

As Policy document is the evidence of contract and it also mention about the beneficiary details, for all kind of benefit payments the policyholder has to submit the original policy document to the Insurer’s office. Moreover it is required for necessary endorsement related to Nomination, Assignment, mortgage etc. In case of lost policy, you have to apply to your Insurer for a duplicate policy.

What is the formality to get a Duplicate Policy.

You have to make a FIR with local PS giving reason of loss of Policy, since when it is noticed & simultaneously have to advertise in local Newspaper. Along with the copies of FIR & advertisement, you have to apply to the Insurer’s respective Branch office along with a nominal fees. If the Insurer is satisfied that the reason of loss is a genuine & there is no attempt of fraud, they will issue the Policy.

If FIR & advertisement is compulsory

These requirements depend on the Sum Assured & left out period of the Policy term. Insurer may waive off these requirements. e.g, if SA is small or the duplicate policy request is in the last year of Policy period before maturity.

The age proof that I submitted at the time of applying for a Policy is not correct. Will there be any Problem in future

Age is extremely vital for acceptance of a Proposal. In case the age is not correct, it is immediately to be brought to the notice of Insurer for them to take a corrective action.

What action the Insurer can take

They may declare the Policy null & void i.e. Cancel the policy , may ask for medical check up or additional special reports, may revise the premium or alter the terms & conditions of the policy by offering alternate plan/term/SA or restrict the benefits.

Suddenly, I noticed that I have not paid the premium since long. Can I pay the premium now

See, under Non linked ( traditional ) policies, Insurer do allows grace period of 30 days for Annual/Half yearly/Quarterly mode of premium & 15 days for monthly mode of premium. If the premium is not paid even within grace period, the Policy lapses. Since you have not paid the premium since long it will depend on the current status of your Policy whether payment of back log premium is possible or not.

How I will know the status of my Policy

You can visit to the website of your Insurer for online services or call them on toll free number (IVRS i.e. voice call ) which is mentioned on the Policy document. After verifying your identity, they may share your Policy status.

I am a layman don’t know how to do all these, what is the alternative

Alternative is, please check the last premium due date paid. First unpaid premium will be Last due paid + Mode e.g, if Last premium paid is June 2015 & mode is yearly then FUP is June 2016. Since it is more than 1 month & grace period is over, it is a lapsed policy. But then since it is within 6 months, you can pay the arrear premium along with interest & a simple declaration of good health form. The Policy will be brought back to in force provided there is no adverse feature in your DGH. If there is any adverse feature, then Insurer may ask for medical report special report etc & decide accordingly.

If the duration of non-payment of premium is more than 6 months cant I revive the Policy

Yes it can be revived under different scheme of revivals like Special revival scheme, Loan cum revival, Instalment cum revival & Survival cum revival scheme. But it can not be revived if the Policy is lapsed for more than 5 yrs.

If I can not revive the Policy, can I get back the premium I paid

In case of Non-linked ( Endowment) Policy, if the Premium is paid for at least 3 yrs & subsequent premium is not paid , the policy becomes paid up & the paid up value is payable on maturity or on death. The paid up policy will not participate into any further benefits. If it is Term or Risk Policy , the premium paid gets forfeited. In case of Unit linked Policy, the risk premium is adjusted out of fund value. Even though, the premium/contribution not paid, if the fund is sufficient to cover up Risk premium & other charges the Policy remains in force.

How much will be the paid up value

The paid up value is calculated as follows; PV = No of Yrs premium paid/No of yrs premium payable (PPT) * Sum Assured. Bonus, if any already vested will be attached is this.

I can not wait till maturity to receive my Paid up amount. & want my money immediately can I do that

Yes you can do that by surrendering the Policy applying to Insurer along with Original Policy document.

How much amount I will get if I surrender my policy

Surrender value will be a certain % of Paid up value. Depending on the time period of surrender from the date of commencement , the % will change. Within 1 st three yrs the % is nil. Higher the duration higher will be the % of SV factor. In case of Unit linked Policy, the surrender value is Fund value less surrender charges. However, surrender charges after 5 yrs of policy period is nil.

I have not made any nomination in my policy. What will happen in case of my death

Nomination facilitates to receive death claim amount. In absence of nomination, the Insurer will go by the law of succession certificate or Probate of will if any. In case, you have someone who have insurable interest on you ( like wife, son, daughter, parents etc ), you can register nomination immediately to avoid legal complication which is time consuming at the same time cost bearing.

I do not have any such person who can be nominated. What do I do

Other than Insurance Policy, you must be leaving behind other properties/assets of yours. In that case, Insurer will go by the Court verdict which will permit simultaneously for other properties/assets of yours.

I want to change my nominee. Can I do that

Yes you can change nomination by sending a request letter to Insurer along with Original Policy document. Insurer will change the Nomination by an endorsement on Policy document.

Can I make multiple nomination

Yes you can make multiple nomination.

Can I assign my Policy

Yes you can assign the policy if you are competent & have rights & title to deal with the policy.

Whom I can assign my Policy

You can assign the policy in favour of Insurer or Bank Against a loan or you can gift it to someone against some consideration which can be love, affection or monetary consideration.

Who will pay premium if I assign my Policy & who will get the claim benefits

If it is against a Loan favouring Insurer or Bank etc, where assignment is of conditional nature, you have to pay premium but claim benefits will go to the lender to adjust loan amount. If the assignment is absolute, then premium will be paid by the assignee & assignee or his survivor will be eligible for the claim benefits.

Can I take a loan on my Policy

This is for information only Endowment type of Policy is eligible for loan. Therefore, TERM/Risk Policy, Unit linked Policy, Annuity Policies & even some endowment policies like Money back are not eligible for loan.

How much Loan I can get

Eligible Loan amount is up to 90% of Paid up value inclusive of Bonus, if any at any point of time.

How I can repay the loan

You can repay the Loan principal along with interest under half yearly mode of payment.

What happen if I don’t repay the loan

If you do not or can not repay the Loan principal , you can only pay the interest . But then, even if you can not pay interest but you continue paying regular premium, the outstanding Loan amount inclusive of interest will be adjusted out of final claim amount. if neither the regular premium nor the principal & interest are paid & if the outstanding Loan amount exceeds the paid up value, the Policy will be foreclosed ( force-surrendered).

How do I know when I will get my maturity benefits

If you see the Policy document date of maturity is mentioned in the schedule. Moreover, as a general practice, Insurer send intimation normally in advance of 2 months prior to maturity date.

What all I have to do to get my maturity benefits

Once, you receive the intimation, you need to sign the discharge voucher giving there in details of your Bank account for direct credit of amount. You also need to submit the Original Policy document along with signed discharge voucher to the Insurance office.

I have a Money Back Policy what all benefits I am entitled to

In a Money back Policy, there is a provision of instalment benefit payable at regular interval depending on the Term of the Policy. Amount of benefit per instalment is a certain % of Sum Insured which normally varies from 10% to 30%.

What maturity benefit I am entitled to get under a money back policy

You are entitled to get Sum Insured +Bonus less the Instalment benefit already received on maturity date.

What happens if I die in between

In case of your unfortunate death, your beneficiary will be eligible to receive full Sum Insured +Bonus up to the date of death without any adjustment of installment benefits already paid to you.

My husband had a Policy but he did not pay the last year premium & died few days back before maturity. Can I get the death benefit

Normally, if the premium is not paid within grace period, policy lapses. But then, in this case, you will get full death benefit less the due premium amount & interest.

My husband had a Policy but he did not pay the premium for more than 6 months. Can I get the death benefit

Some Insurer do consider these cases under concession claim. They honour the claim if death happens within 6 months / 1 year from the date of lapse provided the policy has run for atleast 3 yrs / 5 yrs respectively but after adjustment of due premium & interest from the claim amount.

My husband had a Policy but he died within 2 yrs from the date of commencement of Policy. Can I get the death benefit

If death happens within 2 yrs from the date of commencement of Policy, Insurer consider the case as Early claim & ask for additional information & investigate the case to justify there was no fraud. If they are satisfied, you can get the death benefit.

What all documents will be required to submit for death claim

The following documents are required to be submitted to Insurer office. 1. Intimation of death from any one. 2. Death certificate in original 3. Original Policy document 4. Discharge form In addition may ask for Last Medical attendants report, hospital report, certificate of cremation or burial etc. if death is due to accident following additional documents will be required: 1. FIR 2. Panchnama of accident site 3. Police Final report 4. Post mortem report 5. Hospital reports

My husband had a Policy but he is missing for last few yrs. Can I as a beneficiary claim the death benefit

As per Indian Evidence Act, if a person is missing for more than 7 yrs, it is presumed as death. If the beneficiary represent the case to Court, the Judge may award a decree as presumption of death. But to be entitled for death benefit, the Policy premium should have been paid by the nominee/beneficiary till the date of Decree. However, Insurer may waive off the premium & consider the case.

My husband signed the discharge voucher but died of accident before maturity date, can I get death benefit.

Yes since he has died before maturity date, this will be considered as death claim & if ADB rider is there in the Policy, you will be entitled for twice the Sum Assured.

My husband had a Policy but he availed loan against Policy. How much death benefit I will be entitled

Death benefit will be Sum Assured + Bonus less O/S Loan amount for In force Policy or Paid up amount + added bonus, if any , less O/S Loan amount in case of Paid up Policy.

Although I have submitted all necessary documents to Insurer office but not received the maturity claim . What do I do. Will Insurance Company pay me interest for delay payment

Please call the Insurer office & asked them to know the status of your claim stating the Policy No or Claim Acknowledgement No mentioned in Receipt. In case of genuine delay the Insurer will pay you interest @ 2% above Bank Interest Rate.

Insurer has rejected my death claim request. What do I do.

You can write to the Ombudsman office along with all correspondence & amp; documents. Ombudsman office details are mentioned at the bottom of the Policy document.

I have taken a Unit linked Policy but the amount showing in my balance is much less than what I paid. Why it is so

In a Unit linked Policy, the balance amount after adjusting Risk premium & amp; different charges out of Total premium paid get unitized & amp; the market value of the same reflects in Account balance.

In my Unit linked Policy, what all charges are applicable

Under a Unit linked Policy, normally the charges are Risk premium , Policy administration, Fund Switching Charge, Fund management fees. Beside this there are Surrender charges & Service Taxes.

In my Unit linked Policy, if the return is guaranteed

Unit linked Policy is market-linked & the risk is borne by Policy holder. There is no guarantee of return.

In case of death , if my Unit linked Policy will take care of my Insured sum or will there be any loss

It depends on the Policy condition but mostly the amount payable under a Unit linked Policy is Sum Insured or Fund value whichever is higher.

I have noticed a clause of Premium Holiday in my Unit Linked Policy. What does it mean?. I need not to pay any premium or what

Unlike Traditional Policy where premium has to paid every year, in a Unit linked Policy even you can skip not paying annual premium. If premium is not paid no allocation of unit will be added to the Fund for that period but some units will be deducted for other charges in the policy. This is called Premium Holiday.

I have a Pension Policy. How much Pension I will get

There are two type of Pension Policy 1. Deferred Pension Policy 2. Immediate Pension Policy Under a deferred Pension Policy, premium is paid till the term of the Policy & then the Pension payment starts thereafter. In many Policies Pension amount may be mentioned on the Policy itself else the Pension amount will depend on the accumulated value against premium paid & pension rate at that time. Under immediate Pension Plan, the pension amount depends on the purchase amount & type of pension selected.

I have a Pension Policy. If I die during Policy term what will happen to my policy

If Policyholder dies during term of the Policy, the Sum Insured will be used to purchase pension as per pension type that will be selected by the nominee, provided the Policy was in force at the time of death.

What is deductible

Deductible or “excess†is the amount over and above, which the claim will be payable. There is a normal standard/compulsory excess for most vehicles ranging from Rs 50 for two-wheelers to Rs 500 for Private Cars and Commercial Vehicles which increases depending upon the cubic capacity/carrying capacity of the vehicle. However, in some cases the insurer may impose additional excess depending upon the age of the vehicle or if there is high frequency of claims.

How many Pension options are there

Normally there are 6 type of Pension which are mentioned in the Policy document such as; a. Life Pension ceasing on death b. Life Pension with return of capital c. Joint Life Pension with 100% pension to the spouse d. Joint Life Pension with 50% pension to the spouse e. Pension certain for 5 yrs, 10yrs, 15 yrs, 20yrs & 25 yrs & Life thereafter f. Joint Life Pension with return of capital on death of 2 nd life.

How I will decide which Pension option is best

See all Pension options are good but then depending on your future requirement, you can decide a particular option. However, the Pension amount will vary according to the choice of the Pension type. e.g. If someone does not have any dependant they normally prefer Life Pension here the Pension amount is highest. Alternately, if someone wants his spouse or dependant may need liquid cash in his absence they normally prefer Life Pension with return of cash. Or if someone thinks, in his absence his spouse should have a regular income during his/her lifetime then option c or d is preferable. Pension quantum is lowest in option “e†but then the Pension is guaranteed for the entire certain period so selected and then even thereafter if alive.

If I need liquid cash Can I withdraw my money under a pension Plan.

Once the full premium is paid till the Term & the Pension vest, you are entitled to get 1/3 rd of total value as commutation balance 2/3 rd will be used for Pension purchase. Under immediate Pension Plan, once pension starts you can’t withdraw cash.

I have purchased a Policy from ................Insurance Co. but I am not satisfied. Can I cancel the Policy & get back my money that I paid.

If you are not satisfied with the terms & conditions of the Policy or the benefits which appears in the policy are not the same which was explained to you by the intermediary, you have an option to cancel the policy within 15 days from the date of receipt of Policy document ( free look period) & get back your money less the taxes and medical cost if any, borne by the Insurer in case of Non linked Policy & Fund value less taxes and medical cost in case of Unit linked Policy.

I have lost the Policy document, will there be any problem to get the Policy benefits in future.

As Policy document is the evidence of contract and it also mention about the beneficiary details,for all kind of benefit payments the policyholder has to submit the original policy document to the Insurer’s office. Moreover it is required for necessary endorsement related to Nomination, Assignment, mortgage etc. In case of lost policy, you have to apply to your Insurer for a duplicate policy.

What is the formality to get a Duplicate Policy.Q. What is the formality to get a Duplicate Policy.

You have to make a FIR with local PS giving reason of loss of Policy, since when it is noticed & simultaneously have to advertise in local Newspaper. Along with the copies of FIR & advertisement, you have to apply to the Insurer’s respective Branch office along with a nominal fees. If the Insurer is satisfied that the reason of loss is a genuine & there is no attempt of fraud, they will issue the Policy.

If FIR & advertisement is compulsory

These requirements depend on the Sum Assured & left out period of the Policy term. Insurer may waive off these requirements. e.g, if SA is small or the duplicate policy request is in the last year of Policy period before maturity.

What are the quick points that I need to check in my Vehicle Insurance Policy

All the information must match with your details in RC book including CC, make model, sub type, fuel type, seating capacity (very important) etc.

What are the points that I need to check in the renewal notice

Points are: IDV is reduced by a minimum of 10% from last year, Vehicle Registration No. is correct; Premium is less than the last year (If you have not made any claim.) NCB (If applicable) is more than last year’s NCB. (Maximum 50%) Sometimes the Third Party insurance premium may get revised. This is very rare and it may cause the premium to go up.

What are the factors that one should consider before selecting an insurance company

Ideally the company that has a cashless tie-up with the widest network of service stations that you may visit in case of an accident. Secondly, the company which offers you the best rate without any excess on it. Above all, choose a company that has a good and fastest claim settling ratio and record.

What is the information one needs to furnish while intimating a claim?

The following information needs to be furnished while intimating a claim:Â 1 Name of Insured person who is sick or injured 2 Nature of Sickness/Accident 3 Contact Numbers 4 Policy Number (as reflecting on the Health Card) 5 Date & Time in case of accident, commencement date of symptom of disease in case of sickness 6 Location of accident

Why two insurance company’s premiums are not same

A. All the companies offer 1. Different discounts, 2. Different P.A. cover and 3. Different IDV. It is the reason of difference in premium amounts for all the insurance companies. 1. Different discount: - This mainly depends upon the claims experience of a particular company. If claims experience is good then they will offer higher discount and if claims experience is bad then less discounts are offered. 2. PA (Personal Accident): - PA cover premium will not differ from company to company but it is an optional cover you need to choose the amount how much you want to cover. Eg. One company will offer Rs. 100 as a premium and other company will offer Rs. 250 as a premium. 3. IDV: - Major factor influencing will be IDV. But be very careful, many companies reduce IDV a lot, reduced IDV means your premium will be reduced. Most important point here is at the time of claim insurance company will also have to pay less for your vehicle. (It should be reduced every year by 10% minimum to 20% maximum.) Always keep your IDV on higher side, it helps 1) During claims. 2) At the time of selling car.

What is NCB and how is it calculated

If you don’t make any insurance claim on your vehicle then you are eligible for a No Claim Bonus (NCB). This is a discount on your premium for the coming year and is calculates as under: - 1st year – 0% in Own Damage premium amount 2nd year – 20% in Own Damage premium amount 3rd year – 25% in Own Damage premium amount 4th year – 35% in Own Damage premium amount 5th year – 45% in Own Damage premium amount 6th year – 50% in Own Damage premium amount

How is depreciation on the various parts calculated

A Deduction for depreciation on various parts is calculated as under: - For all rubber/nylon/plastic parts/tyres/tubes, batteries & air bags – 50% For fibre glass components – 30% For all parts made of glass – 0% Rate of depreciation for all other parts including wooden parts will be as per age of the vehicle as follows; 7th month to 1st year – 5% 1st year to 2nd year – 10% 2nd year to 3rd year – 15% 3rd year to 4th year – 25% 4th year to 5th year – 35% 5th year to 10th year – 40% More than 10 year – 50%

What is Excess? Is Excess good or bad

Excess means the amount that will be deducted by the insurance company before making the payment to insured. There are two types of excesses. First one is compulsory which depends upon the C.C. (cubic capacity)of the vehicle and which cannot be removed from insurance policy. The second is a voluntary excess, which is given to you for reducing the premium in the policy. This is not a recommended option to avail, since it reduces the insurance claim payout if its needed. Never agree for higher excess.

What is covered under own car damage

Vehicle replacement cost or Vehicle repairing cost is paid if you have opted for this cover in your policy.

When should a vehicle be scrapped (Under total loss)

In case of an accident where the repair cost is more than 75% of car value (IDV), then insurance company will scrap the vehicle and pay the insurer the entire value of the vehicle.

When do insurance companies not pay the full IDV

If you have not reduced the car value every year minimum by 10% from last year’s IDV, then your insurance company will not pay the IDV. If you have increased the car value without any valid reason than also insurance company will not pay the entire IDV.

What is covered under third party insurance

In case of an accident, third party property damage and third party life damage is compensated.

If third party vehicle is smashed beyond repair what is my liability

Nothing. If you have valid insurance documents then entire loss is paid by insurance company and you don’t have to spend a single penny from your pocket.

Is the dispute between the insurance company and others, Am I a party to the dispute

No. once you handover the court case and papers to insurance company then they take over the case. You may however need to go once to court.

If the fault is completely mine and I also agree to same, does my liability change

No, not at all. The premium you pay covers for potential mistakes on your side.

In case of physical injury or death of passengers in my vehicle, are the medical expenses covered? Is there a special type of insurance cover

Under third party cover there is a clause called Unnamed Passenger PA (personal accident) cover. If you have opted for this cover (which is available on extra premium of maximum Rs. 100/- per person for a coverage of Rs. 2,00,000/-) then there is compensation payable to the family members in case of death. There is no cost of medical bills or any expenses payable to the injured passengers. Currently there are no options (products) for getting this covered through vehicle insurance.

Are third party medical expenses covered? Is there a special type of insurance cover

Yes. The entire expenses are paid under TP(Third Party) policy, if there is a police case, you don’t have to opt for any special policy. Unlimited medical expenses are paid under TP policy.

In case of theft, how much will the insurance companies pay

Entire IDV minus excess is paid.

What is the reason for not paying the entire IDV under insurance policy, if vehicle is stolen

If you have not reduced the car value every year minimum by 10% from last year’s IDV, then your insurance company will not pay the IDV. If you have increased the car value without any valid reason, then also insurance company will not pay the entire IDV.

Do I lose my NCB in case of theft of my car

Yes. If there is a theft and you make a claim, you lose the NCB.

How much time does it take to settle my claim, under theft insurance

There are lots of documents which have to be submitted in case of theft insurance. (Approximately number = 18). Post submission of all those documents, you will be required to submit a "Final Investigation Report (FIR)". This is usually issued by/from police station after approx 3 months of the theft. The claim is paid one month after the submission of the FIR.

My Insurance has expired yesterday is there a grace period after last date for renewal without inspection/penalty

There is no grace period in Motor insurance. The NCB savings will elapse after 3 months.

Can I renew my insurance without an inspection

For third party it does not matter. But it’s mandatory for comprehensive insurance.

Can NCB be transferred if I change my insurance company

Yes. Your car carries the NCB; every company has to accept it.

What is the procedure to transfer my existing NCB to new car insurance

When you sell your car, you have to submit Form 29 & 30 to insurance company, which has information about buyer and seller including their signatures. This verifies that you have sold your car. Company then issues a No Claim Bonus Certificate which can be used on your new car.

Is an FIR required when I make a claim for a repair? (Given there are not legal issue with the damage)

It depends on a case to case basis. If a tree fell on the car and destroyed it, you can get full IDV back without an FIR.

If I lodge a claim after the expiry of my policy date for an event that occurred during the policy period, will it still be valid

Yes, you will be eligible for the claim even after the expiry of the policy date. This is because the event took place during the policy period.

Will the claim affect my renewal

In case you file a claim for any kind of damages during the insured period, at renewal, you will loose all the NCB that you have accrued over the years.

Please provide me with the list of garages in my city where I can avail cashless service

Kindly go through the list of garages where you can avail of the cashless service.

currently have a policy with other company, will I get the NO CLAIM bonus if I renew it with you

In the event of no claims, you would avail of the 'NO CLAIM' bonus, i.e., there would be a reduction of for payment of premium on renewal. If you do not make any claim over a period of time, a No Claim Bonus (NCB) is offered on renewals. This discount can go as high as 50%. However, if there is any claim, the discount (NCB) will be zero for the next renewal.

What is the procedure for recording any changes in the policy

If there are any changes in the policy like change of address or modifications to the vehicle or its use, it will be done by an Endorsement by the insurance company. Submit a letter to the insurer with proof for the changes and obtain the endorsement. Some endorsements may require you to pay additional premium. Check the correctness of the endorsement.

What is a Certificate of Insurance under Motor Vehicle Act

As per Rule 141 of Central Motor Vehicle Rules 1989, a certificate of Insurance is to be issued only in Form 51. It is only in Motor Vehicle Insurance, apart from the policy, that a separate certificate of insurance is required to be issued by insurers. This document should always be carried in the vehicle. The policy should be preserved separately at home / office.

If I fit CNG or LPG kit in my vehicle, is it necessary to inform the Insurance Company

If a CNG / LPG kit is fitted in the vehicle, the (Road Transport Authority (RTA) office where the vehicle was registered should be informed so that they make a note of the change in the registration certificate (RC) of the vehicle. The insurance company should also be informed so that the kit is covered on payment of extra premium on the value of the kit under “OD†section and also under “LO†section.

What are the documents to be kept in the vehicle while plying in public places

Documents are : • Certificate of Insurance • Xerox copy of Registration Certificate • Pollution Under Control Certificate • Photocopy of Driving Licence of person who is driving the vehicle

Can I transfer my insurance to the purchaser of my vehicle

Yes, the insurance can be transferred to the buyer of the vehicle, provided the seller informs in writing of such transfer to the insurance company. A fresh proposal form needs to be filled in. There is a nominal fee charged for transfer of insurance along with pro-rata recovery of NCB from the date of transfer till policy expiry. It may be noted that transfer of ownership in comprehensive/package policies has to be recorded within 14 days from date of transfer failing which no claim will be payable for own damage to the vehicle.

Can I continue the insurance in the name of the previous owner even after the vehicle is transferred in RTO records in my name

No. Registration and insurance of the vehicle should always be in the same name with the same address. Otherwise the claim is not payable. A fresh proposal form needs to be filled in. There is a nominal fee charged for transfer of insurance.

I have lost the insurance policy. Can I get a duplicate one

Yes, please approach the same office, which had issued the policy, with a written request. A nominal fee is charged for issuing a duplicate policy copy.

What are the formalities for a motor insurance claim

A claim under a motor insurance policy could be ? For personal injury or property damage related to someone else. This person is called a third party in this context) or ? For damage to your own, insured, vehicle. This is called an own damage claim and you are eligible for this if you are holding what is known as a package or a comprehensive policy. Third Party Claim In a third party claim, where your vehicle is involved, it is important to ensure that the accident is reported immediately to the police as well as to the insurance company. On the other hand, if you are a victim, that is, if somebody else’s vehicle was involved, you must obtain the insurance details of that vehicle and make an intimation to the insurer of that vehicle. Own Damage Claim In the event of an own damage claim, that is, where your own vehicle is damaged due to an accident, you must immediately inform insurance company and police, wherever required, to enable them to depute a surveyor to assess the loss. Do not attempt to move the vehicle from the accident spot without the permission of police and the insurance company. Once you receive permission for removal of the vehicle and for repairs, you can do so. If your policy provides for cashless service, which means you do not have to pay out of your pocket for covered damages, the insurance company will pay the workshop directly. In either of these situations, you must intimate the insurance company immediately. Theft ClaimIf your vehicle is stolen, you must inform the police and the insurance company immediately. In addition you must keep the transport department also informed. As soon as you receive the policy document, read about the procedures and documentation requirements for claims rather than wait for a claim to arise. If you have to make a claim, ensure that you collect all the required documents and submit them along with the requisite claim form duly filled in, to the insurance company. There may be certain specific documentation requirements for specific types of claims. For instance in respect of a theft claim, there is a special requirement that you should surrender the vehicle keys to the insurance company.

When should I report to the police

Incidents such as "Third Party Property Damage", "Bodily Injury To Self or Third Party" or "Theft" should be reported to the nearest police station, under whose jurisdiction the incident has occurred.

What if someone else was driving at the time of the accident? Is that person covered by my policy? Will I still be covered

If the person driving the vehicle is a valid license holder, the vehicle is insured for all the accidents that occurred due to the hazards specified. To insure the person driving the vehicle, who is not the owner, an additional personal accident cover has to be taken for unnamed passengers. For the owner-driver, the policy compulsorily has a personal accident cover, as per tariff.

What if I have an accident with an uninsured vehicle? What is the extent to which I covered

If you have taken a comprehensive policy for your vehicle you are fully covered against all the hazards mentioned, irrespective of whether the other person has an insurance policy or not.

What documents are required to file a claim online

In case of own damages claim following documents are required: ? Claim form duly signed ? Valid R.C. copy of the vehicle ? Valid driving license copy ? Policy copy (First 2 pages only) ? FIR if required (For Theft, Third party Injury / Damage; Highway accidents-Major only). ? Original repair bill, proof of release and cash receipt.

What if I have an accident with an uninsured vehicle? What is the extent to which I am covered

If you have taken a comprehensive policy for your vehicle you are fully covered against all the hazards mentioned, irrespective of whether the other person has an insurance policy or not.

I am already having health insurance and want to increase sum insured, what should I do?

You can take super top up plan and increase your sum insured to desired level.

I was forced to take a Travel Insurance Policy. Is it a mandatory requirement?

To obtain a visa for some countries, overseas travel insurance is compulsory.

Where it is not a mandatory requirement, why should I take a Travel Insurance Policy?

Even where it is not, it is prudent to obtain a travel insurance policy when you are travelling on business or holiday or for education, research etc as medical treatment costs in many countries are much higher than what they are in India and are unaffordable.

Is my visa status relevant to obtain overseas travel insurance?

In most cases it would be. Normally, such policies are meant for travellers who visit other countries on business or holiday or education or other purposes and not for those residing permanently abroad.

I was forced to take a Travel Insurance Policy. Is it a mandatory requirement

To obtain a visa for some countries, overseas travel insurance is compulsory.

Where it is not a mandatory requirement, why should I take a Travel Insurance Policy

Even where it is not, it is prudent to obtain a travel insurance policy when you are travelling on business or holiday or for education, research etc as medical treatment costs in many countries are much higher than what they are in India and are unaffordable.

Is my visa status relevant to obtain overseas travel insurance

In most cases it would be. Normally, such policies are meant for travellers who visit other countries on business or holiday or education or other purposes and not for those residing permanently abroad.

What is the Validity / Policy period in my Policy

The Insurance is valid from the 1 st day of Insurance or date & time of departure from India whichever is later and expires on the last day of the number of days specified in the policy schedule or return to India whichever is earlier.

Can I travel anytime during Policy period

The Policy will be valid only if the journey commences within 14 days of issuance date of Policy.

Can I extend my policy period

There is an automatic extension of 7 days period without any charge, if necessitated by delay of public transport services beyond the control of insured person.

Can I get refund of my premium if i cancel the trip or cut shot the trip.

In case your travel doesn’t take off and you show proof of the same, policies would normally provide for premium refund subject to deductions towards administrative costs. Where travel is cut short, policies may or may not allow refund subject to certain conditions.

What all benefits are covered under a Travel Policy

It covers the following benefits: 1. Medical expenses & repatriation 2. Personal Accident 3. Loss of checked Baggage 4. Delay of checked Baggage 5. Loss of Passport 6. Personal Liability

Q. Can I claim any medical expenses during my overseas stay?

A. No, certain expenses are not covered as in below; 1. treatment that could reasonably be delayed until return to India 2. cosmetic surgery unless as a result of accident 3. routine physical examination 4. Pregnancy related expenses including childbirth, miscarriage, abortion or any complication.

If I die overseas what all benefits it will cover

Air transportation expenses or up to an equivalent amount for a local burial or cremation in the country where the death occurred.

what are the general exclusions in a Travel Policy

No claim will be paid in cases: 1. Where the insured person is travelling against the advice of the Physician, is travelling to obtain medical treatment, is on waiting list for a medical treatment, has a terminal prognosis of a medical condition. 2. Suicide, attempted suicide, venereal disease, HIV etc 3. Arising due to taking part in Naval, Military, Air force operations, Aviation, Professional sports or hazardous sports.

what are the claim process

Formalities for making a travel insurance claim A travel insurance policy is generally a package policy that includes different types of covers like hospitalisaiton, personal accident, loss/ damage to baggage, loss of passport and so on. The procedure and documents required for a claim would vary from cover to cover. All of them would be mentioned in your policy document. For ease of procedure and your convenience, insurers normally attach the claim form with the policy document. This will contain the list of documents required in case of a claim and also the contact details including phone numbers of the claims administrator either in the destination country to which you are travelling or in another country that is designated to receive and process your claim intimation.

Absolute Liability

Liability for damages even though faults or negligence cannot be proven.

Absolute Ownership

Absolute ownership exists where the interest or explicit right of possession of the insured is so free from limitations, qualifications or restrictions that it cannot be taken from him without his consent.

Abstract

A brief history of title to land.

Acceptance Of Risk

Acceptance of Risk is a method of assessment of risk in a Proposal by an underwriter to decide whether to accept the risk or not and if to accept at what terms & condition.

Accelerated Death Benefit

A percentage of the policy’s face amount discounted for interest that can be paid to the insured prior to death, under specified circumstances. This is in lieu of a traditional policy that pays beneficiaries after the insured’s death. Such benefits kick in if the insured becomes terminally ill, needs extreme medical intervention, or must reside in a nursing home. The payments made while the insured is living are deducted from any death benefits paid to beneficiaries.

Accident

An event or occurrence causing damage/injury to an entity and is unforeseen and unintended.

Accidental Bodily Injury

Injury to the body as the result of an accident.

Accident, Hit And Run

Accidental Death or injury arising out of the use of a motor vehicle(s) the identity whereof cannot be ascertained in spite of reasonable efforts for the purpose.

Accompanied Baggage

Baggage being taken by someone with his own person whilst travelling.

Accumulation

Percentage addition to policy benefits as a reward to the insured for continuous renewal.

Acquisition Costs

The insurer's cost of putting a new business in force, including the agent's commission, the cost of clerical work, fees for medical examinations and inspection reports, sales promotion expense, etc.

Accidental Death Benefit

An endorsement that pays the beneficiary an additional benefit if the insured dies from an accident.

Accounts Receivable (debtors) Insurance

Indemnifies for losses that are due to an inability to collect from open commercial account debtors because records have been destroyed by an insured peril.

Acts Of God

Perils that cannot reasonably be guarded against, such as floods and earthquakes.

Actual Cash Value

A form of insurance that pays damages equal to the replacement value of damaged property minus depreciation.

Actual Loss Ratio

The ratio of losses incurred to premiums earned actually experienced in a given line of insurance activity in a previous time period.

Actuarial Cost Assumptions

Assumptions about rates of investment earnings, mortality, turnover, salary patterns, probable expenses, and distribution or actual ages at which employees are likely to retire.

Actuarial Cost Methods

Methods for computing how much money must be contributed each year to fund pensions.

Actuary

An insurance professional skilled in the analysis, evaluation, and management of statistical information. Evaluates insurance firms reserves, determines rates and rating methods, and determines other business and financial risks.

Additional Insureds

Persons who have an insurable interest in the property/person covered in a policy and who are covered against the losses outlined in the policy. They usually receive less coverage than the primary named insured.

Additional Living Expenses

Extra charges covered by homeowners policies over and above the policy-holder’s customary living expenses. They kick in when the insured requires temporary shelter due to damage by a covered peril that makes the home temporarily uninhabitable.

Adjuster

An individual employed by a property/casualty insurer to EV adjusters differ from public adjusters, who negotiate with insurers on behalf of policyholders and receive a portion of a claims settlement. Independent adjusters are independent contractors who adjust claims for different insurance companies.

Admitted Company

An insurance company licensed and authorized to do business in a particular state or country.

Adverse Selection

The tendency of those exposed to a higher risk to seek more insurance coverage than those at a lower risk. Insurers react either by charging higher premiums or not insuring at all. In the case of natural disasters, such as earthquakes, adverse selection concentrates risk instead of spreading it. Insurance. works best when risk is shared among large numbers of policyholders.

Affinity Sales

Selling insurance through groups such as professional and business associations.

Affirmative Warranty

An agreement between an insurance company and an agent, granting the agent authority to write insurance from that company. It specifies the duties, rights, and obligations of both parties.

Aggravation Of Risk

To make the existing risk worse, more troublesome, etc.

Agreed Value Policy

The policy which undertakes to pay a specified amount in case of total loss. Under this case, the policy does not take into account the current market value.

Agent

Insurance is sold by two types of agents: independent agents, who are self-employed, represent several insurance companies and are paid on commission, and exclusive or captive agents, who represent only one insurance company and are either salaried or work on commission. Insurance companies that use exclusive or captive agents are called direct writers.

Aggregate Deductible

A type of deductible that applies for an entire year in which the insured absorbs all losses until the deductible level is reached, at which point the insurer pays for all loses over the specified amount.

Aggregate Limits

A yearly limit, rather than as per occurrence limit. Once an insurance company has paid up to the limit, it will pay no more during that year.

Aircraft Damange

Destruction or damage caused by Aircraft, other aerial or space devices and articles dropped there from excluding those caused by pressure waves.

Aleatory Contract

A legal contract in which the outcome depends on an uncertain event. Insurance contracts are aleatory in nature.

All-risk Agreement Or Policy

A property or liability insurance contract in which all risks of loss are covered except those specifically excluded; also called open perils policy.

Alternative Dispute Resolution (adr)

Alternative to going to court to settle disputes. Methods include arbitration, where disputing parties agree to be bound to the decision of an independent third party, and mediation, where a third party tries to arrange a settlement between the two sides.

Alternative Markets

Mechanisms used to fund self-insurance. This includes captives, which are insurers owned by one or more non-insurers to provide owners with coverage. Risk-retention groups, formed by members of similar professions or businesses to obtain liability insurance, are also a form of self-insurance.

Ancillary Charges

In hospital insurance, covered charges other than room and board.

Annual Statement

Summary of an insurer’s or reinsurer’s financial operations for a particular year, including a balance sheet.

Annual-premium Annuity

An annuity whose purchase price is paid in annual instalments.

Annuitant

An individual receiving benefit under an annuity.

Annuity

A life insurance company contract that pays periodic income benefits for a specific period of time or over the course of the annuitant’s lifetime. These payments can be made annually, quarterly or monthly. From a life insurer’s viewpoint, an annuity presents the opposite of mortality risk from a life insurance policy. Life insurance pays a benefit when the policyholder dies. An annuity pays benefits as long as the annuitant lives. With both products, the insurer’s profit or loss depends on whether it made correct assumptions about the policyholder’s life expectancy and the company’s future investment returns.

Annuity Certain

An annuity that is payable for a specified period of time, without regard to the life or death of the annuitant.

Annuity Units

A measure used in valuing a variable annuity during the time it is being paid to the annuitant. Each unit’s value fluctuates with the performance of an investment portfolio.

Application Form

Supplied by the insurance company, usually filled in by the agent and medical examiner (if applicable) on the basis of information received from the applicant. It is signed by the applicant and is part of the insurance policy if it is issued.

Apportionment

The dividing of a loss proportionately among two or more insurers that cover the same loss.

Appraisal

A survey to determine a property’s insurable value, or the amount of a loss.

Arbitration

Procedure in which an insurance company and the insured or a vendor agrees to settle a claim dispute by accepting a decision made by a third party.

Arson

The deliberate setting of a fire

Assessable Policy

A policy subject to additional charges, or assessments, on all policyholders in the company.

Assets

Property owned, in this case by an insurance company, including stocks, bonds, and real estate. Insurance accounting is concerned with solvency and the ability to pay claims. Insurance laws, therefore, require a conservative valuation of assets.

Assign

To use life insurance policy benefits as collateral for a loan.

Assignee

The party to whom the rights of the insured under a policy are transferred.

Assignment

A clause that allows the transfer of rights under a policy from one person to another, usually by means of a written document.

Assignor

The party granting the transfer of the insured’s rights to the assignee

Asymmetric Information

An insured’s knowledge of likely losses that is unavailable to insurers.

Auto Insurance Premium

The price an insurance company charges for coverage, based on the frequency and cost of potential accidents, theft and other losses.

Automatic Coverage

An insurer agrees to cover accidents from all machinery of the same type as that specifically listed in the endorsement.

Automatic Treaty

An agreement whereby the ceding company is required to cede some certain amounts of business and the reinsurer is required to accept them.

Adjusters

A name applied to claims adjusters in the field of marine insurance.

Aviation Insurance

Commercial airlines hold property insurance on aeroplanes and liability insurance for negligent acts that result in injury or property damage to passengers or others. Damage is covered on the ground and in the air. The policy limits the geographical area and individual pilots covered.

Avoidance

A right which can be exercised by an underwriter to relieve him of liability under the policy because the assured has been guilty of a breach of good faith or where the risk in voyage policy has failed to attach within a reasonable time after the underwriter wrote the risk.

Award

The decision in arbitration.

Aai (automobile Association Membership Discount)

Member of Automobile Associations is eligible for a discount. A discount @ 5% of the Own damage premium, subject to a maximum of Rs.200/ - for a Private Car and maximum of Rs.50/-for a Motorized Two Wheeler may be allowed.

Additional Driver Cover

the passengers or a hired driver are not covered under personal accident insurance. Third party cover does not include cover for your legal liability towards your paid driver. Therefore, if your car is not self-driven you need to buy a cover for your driver, under the Workmen Compensation Act

Additional Passenger Cover

This cover can be purchased with an additional premium . This covers the medical expenses of passengers in case of bodily injury due to an accident. Normally the cover is Rs 1 lakh per passenger.

Amount Payable

A payable amount is simply another way of describing a balance that is still owed or due.

Ayurveda/homeopathy

Ayurveda is an ancient medical science. The word, ayurveda is composed of two words of Sanskrit, ayur (meaning life) and veda (meaning knowledge). Thus Ayurveda is a medical science of Ancient India. It deals with matters relating to health, day-to-day life and longevity (long life).

Availed Riders

A rider is an add-on provision to a basic insurance policy that provides additional benefits to the policyholder at an additional cost. Eg ADB,CI, TI, APTD, WOB etc.

Accidental Permanent Total Disability

Accidental permanent disability rider provides a certain % of Sum assured in case of permanent loss of body parts or functions out of accidents within 180 days from the date of accident.

Bailment

A situation in which one has entrusted personal property to another.

Balance Sheet

Provides a snapshot of a company’s financial condition at one point in time.

Basic Health Insurance Policy

Hospital insurance, surgical insurance and regular medical expense insurance

Basic Limit

Usually, refers to Liability of insurer indicating the lowest amount for which a policy can be written. This amount is either prescribed by law or company policy.

Basic Rate

The standard charge for a given type of risk for basic limit.

Beneficiary

A person named in a life insurance policy to receive the death proceeds.

Bill Of Exchange

It is the bill drawn by exporter against the importer.

Bill Of Lading

Receipt for goods shipped on board a ship signed by the person who contracts to carry them, and stating the terms on which the goods are carried.

Bind

In property and liability insurance, the agent customarily is given the authority to accept offers from prospective insureds without consulting the insurer; in such cases, the agent is said to bind the insurer.

Binder

Temporary authorization of coverage issued prior to the actual insurance policy.

Blanket Bond

A fidelity bond that covers all employees of a given class and may also cover perils other than infidelity.

Blanket Coverage

Insurance coverage for more than one item of property at a single location, or two or more items of property in different locations.

Blanket Contract

A contract of health insurance affording benefits, such as accidental death and dismemberment, for all of a class of persons not individually identified. It is used for such groups as athletic teams, campers, travel policy for employees, etc.

Boiler And Machinery Insurance

Often called Equipment Breakdown, or Systems Breakdown insurance. Commercial insurance that covers damage caused by the malfunction or breakdown of boilers, and a vast array of other equipment including air conditioners, heating, electrical, telephone, and computer systems. Prevention of loss is emphasized even more than indemnification of loss.

Bodily Injury

Physical injury, including sickness, disease, mental injury, shock or death.

Bonus

The Bonus system awards discounts for claim-free driving for a certain continuous period. This goes on increasing up to a certain limit for continuous claim free years. In case of life insurance business, with profit plans are entitled to get a bonus which is generated out of actuarial surplus.

Borderline Risk

An insurance prospect of doubtful quality from an underwriting point of view to put it in one among two group of risks.

Bond

A security that obligates the issuer to pay interest at specified intervals and to repay the principal amount of the loan at maturity. In insurance, a form of surety-ship. Bonds of various types guarantee a payment or a reimbursement for financial losses resulting from dishonesty, failure to perform and other acts.

Book Of Business

Total amount of insurance on an insurer’s books at a particular point in time.

Breach Of Condition

When a condition of the insurance contract is broken by the assured, the insurer may avoid the contract from the inception.

Broker

An intermediary between a customer and an insurance company. Brokers typically search the market for coverage appropriate to their clients. They work on commission and usually sell commercial, not personal, insurance. In life insurance, agents must be licensed as securities brokers/dealers to sell variable annuities, which are similar to stock market-based investments.

Burglary

The unlawful taking of property from within premises, entry to which has been obtained by force, leaving visible marks of entry.

Burglary And Theft Insurance

Insurance for the loss of property due to burglary, robbery or larceny. It is provided in a standard homeowners policy and in a business multiple peril policy.

Burning Ratio

The ratio of losses suffered to the amount of insurance in effect.

Business Income Insurance

Coverage for the reduction in revenue in the event of an insured peril.

Business Interruption Insurance

Commercial coverage that reimburses a business owner for lost profits and continuing fixed expenses during the time that a business must stay closed while the premises are being restored because of physical damage from a covered peril, such as a fire. Business interruption insurance also may cover financial losses that may occur if civil authorities limit access to an area after a disaster and their actions prevent customers from reaching the business premises. Depending on the policy, civil authorities coverage may start after a waiting period and last for two or more weeks.

Business Pursuit

Continued or regular activity for the purpose of earning a livelihood.

Businessowners Policy

A policy that combines property, liability and business interruption coverage for small to medium sized businesses. Coverage is generally cheaper than if purchased through separate insurance policies.

Baby Vaccination

It covers the expenses incurred for the compulsory baby vaccinations

Cancelable

A health policy that can be cancelled by the insurer at any time for any reason

Capacity

The supply of insurance available to meet demand. Capacity depends on the industry’s financial ability to accept the risk. For an individual insurer, the maximum amount of risk it can underwrite based on its financial condition. The adequacy of an insurer’s capital relative to its exposure to loss is an important measure of solvency.

Capital Sum Insured

It is the sum insured of a Person for which cover is sought under a Personal Accident Policy.

Captive Agent

A person who represents only one insurance company and is restricted by agreement from submitting business to any other company, unless it is first rejected by the agent’s captive company.

Captive Insurer

A type of insurer that is generally formed and owned by potential insured to meet their own distinctive needs

Captives

Insurers that are created and wholly-owned by one or more non-insurers, to provide owners with coverage. A form of self-insurance.

Cargo Insurance

Type of insurance that protects the shipper/owner of the goods against financial loss if the goods are damaged or lost while in transit in between place of commencement and destination.

Case Management

A system of coordinating medical services to treat a patient improves care, and reduce cost. A case manager coordinates health care delivery for patients.

Cash Value

The savings element that accumulates with some life insurance policies.

Cash Value Option

An option in life insurance policies permitting the insured to take the cash value of the policy on surrender.

Cashless

It is a health insurance plan for when you get hospitalized within a Health Insurance network hospital and don’t have to pay for the hospital expenses.

Catastrophe